50+ should i pay last mortgage payment before closing

Web If your mortgage is due on the first of the month but has a late-fee grace period until the 15th then you might skip the payment pay the late fee and pocket the. Web Here are 10 things you should avoid doing before closing your mortgage loan.

2022 Final Expense Insurance Guide Costs For Seniors

Apply Get Pre-Approved Today.

. For example if your mortgage is 350000 with a 20. Pay down credit card. You can often do this through the servicers website.

Buy a big-ticket item. Ad Looking For Conventional Home Loan. Ad Get an Affordable Mortgage Loan With Award-Winning Client Service.

Web A late fee is generally 4 to 5 of your payment amount. Web The mortgage payment you make on June 1 will include the loan principal and the loan interest for May. The due date for your initial mortgage payment depends on the closing date and its usually more than 30.

Compare Lenders And Find Out Which One Suits You Best. Compare the Best Conventional Home Loans for February 2023. Web Not all lenders charge this fee and you probably dont need to worry about it if youre waiting more than five years to pay off your mortgage.

Ad Increasing Mortgage Payments Could Help You Save on Interest. Web When is the first mortgage payment due after closing. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Find A Lender That Offers Great Service. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

But you should always ask your lender first. Web Late payments on mortgages are not reported unless they are more than 30 days late. Web Before you can make your final mortgage payment youll need to ask your loan servicer for a payoff quote.

As a general rule expect to pay about 35 a month for every 100000 in home. Our Home Loan Experts Can Help. Web If you exceed your mortgage loans 15-day grace period your lender will classify your payment late with a fee applied.

Curious How Much You Will Need To Pay In Closing Costs. Web Your first mortgage payment will be the same as your future monthly mortgage payments. Web Learn if you can qualify for a mortgage with recent late payments.

That fee can be anywhere from four to six. Web Your first payment will generally be on the first day of the month following your first 30 days of ownership but when you close can affect how much time you have. Find tips on how to increase your credit score before applying for a mortgage loan.

A car a boat an expensive piece of furniture. Web As mentioned above sometimes your mortgage lender will lump your final mortgage payment into your closing which means you wont have to pay your normal monthly. Web If you close toward the beginning of the month you wont have a mortgage payment for almost two months but you will need to bring more money to closing to cover the.

So as long as your closing isnt delayed I probably wouldnt make the payment. However since you closed on April 16 you will have to. Ad Calculate Your Payment with 0 Down.

Ad Compare More Than Just Rates. Web Many lenders require you to pay for a years worth of homeowners insurance at closing. Once a mortgage payment is 30 days late it shows up on your credit report and can have a major negative.

Enterprise Membership Housingwire

Faqs On Mortgages And The Coronavirus

No 10 Considers 50 Year Mortgages That Could Pass Down Generations Mortgages The Guardian

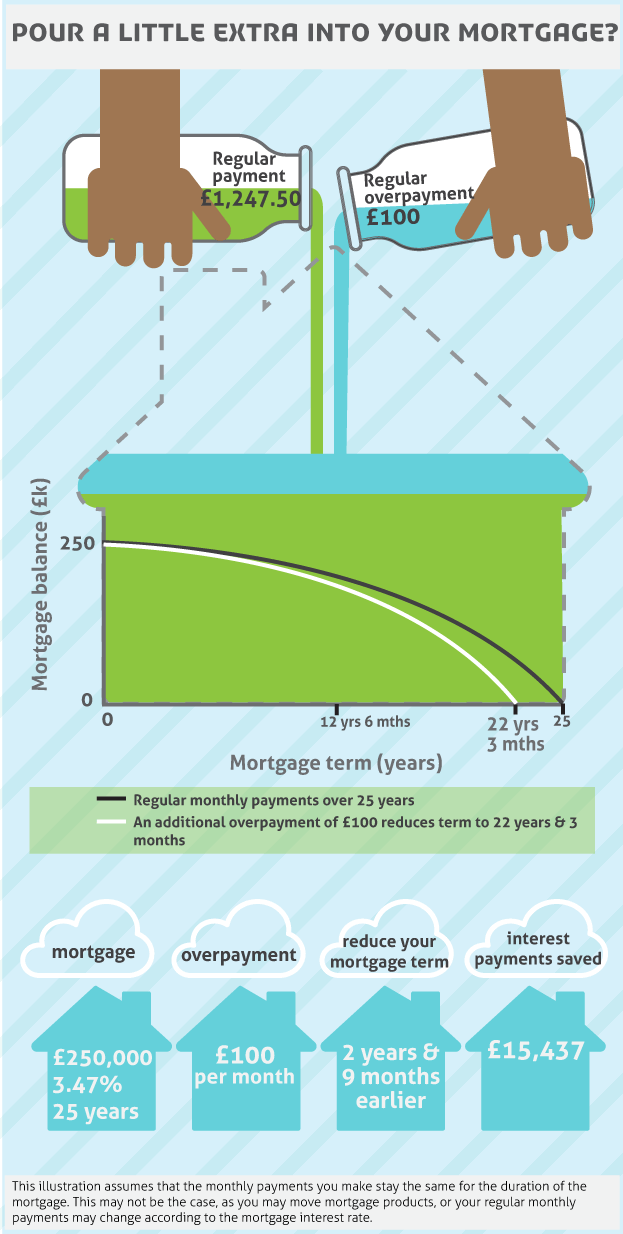

Should I Pay Off My Mortgage Early With Savings Ybs

First Time Buyers Face A Brutal Housing Market The New York Times

Mortgage Boot 1031 Exchange Guide Debt Reduction Principle

What S The Right Downpayment On A House Synchrony Bank

2023 Housing Trends To Watch Opendoor

The Top 100 Software Companies Of 2021 The Software Report

First Commerce Bank

Here S Why Your Credit Score Matters And How To Improve It

Mortgage Due Dates 101 Is There Really A Grace Period

Top 50 Master Planned Communities Of 2021 John Burns Real Estate Consulting

:max_bytes(150000):strip_icc()/buy-house-early-GettyImages-1053478838-228174c119d4428e9547117194cc3e61.jpg)

10 Early Steps To Take Before You Decide To Buy A Home

Consider The Risks Of Private Mortgages New Brunswick Financial And Consumer Services Commission Fcnb

Home Loans And Refinance Movement Mortgage

Qsjgq899qgkthm